Employment termination payments that meet the definition of ‘genuine redundancy’ are entitled to concessional tax treatment. You must receive these amounts as cash payments. They cannot be automatically rolled into superannuation but if you are still eligible, you may be able to make a contribution into superannuation.

How it works

A genuine redundancy may occur when your employer decides that the job you are doing no longer exists and terminates your employment. Termination payments made under these circumstances receive special tax treatment where part of the payment is tax free.

Your employer is required to provide you with a payment summary within 14 days of making your termination payment. The payment summary sets out the amount paid and the amount of tax withheld.

Your termination payment may include unused leave entitlements and an extra ‘redundancy’ amount which is determined according to the terms of your employment contract. The redundancy amount will be tax-free up to a limit, with any excess being taxed as an employment termination payment (ETP).

Unused leave entitlements

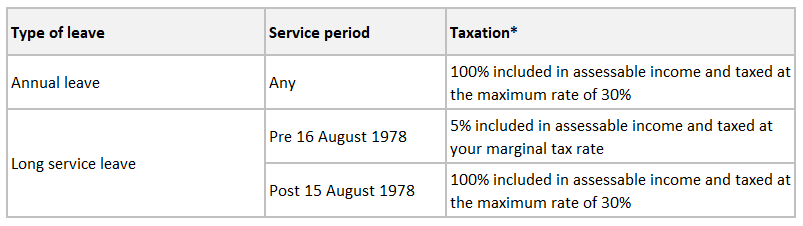

Any payments for unused annual and long service leave are included in your assessable income and can impact your entitlements to certain tax offsets or benefits or other liabilities. However, the Tax Office uses an offset system to ensure the rate paid on these unused leave payments is limited to the tax rates shown in the following table:

* Medicare and other levies may also apply

Genuine redundancy tax-free amount

A portion of a genuine redundancy amount (not including the leave payments) will be tax-free if you are age 65 (or under the retirement age specified in your employment award) on the date of your termination. The tax-free amount is based on your years of completed service with your employer. For 2018/19, the genuine redundancy tax-free amount is calculated as:

$10,399 + ($5,200 x each completed year of service)

If your redundancy amount is less than the result of this formula, it will be entirely tax-free and you only pay tax on the leave payments.

Employment termination payment (ETP)

If your redundancy amount (not including leave entitlements) is greater than the tax-free amount, the balance is generally called an ETP.

Most ETPs consist of only a taxable component, however a tax-free component will exist if you commenced working for your employer before 1 July 1983 or you are terminating employment due to invalidity.

Your employer will withhold lump sum tax from the taxable component of the ETP depending on your age and the amount of the ETP. Lump sum tax rates for 2018/19 are as follows

* Rates and thresholds apply for 2018/19 financial year. Medicare and other levies may also apply.

^ Applies if payment is received after preservation age or in the year in which preservation age will be reached.

Consequences

The taxable component of the ETP is added to your assessable income and may impact your entitlement to certain tax offsets and concessions or other liabilities.

The value of the ETP and unused leave payments count towards the Centrelink income maintenance period, which may result in you being excluded from receiving Centrelink benefits for a period of time. This period is generally the number of weeks’ salary that the payments equate to.

Date: 1 July 2018