Your self-managed super fund (SMSF) needs to be set up correctly so that it's eligible for tax concessions, can receive contributions, and is as easy as possible to administer.

To set up an SMSF you need to:

Consider appointing professionals to help you

Choose individual trustees or a corporate trustee

Appoint your trustees

Create the trust and trust deed

Check your fund is an Australian super fund

Register your fund and get an ABN

Set up a bank account

Get an electronic service address

Prepare an exit strategy

Each of these steps is explained below.

1: Consider appointing professionals to help you

You can engage self-managed super fund (SMSF) professionals to help you set up and run your fund. You may want to get them involved right from the start since the decisions you make at start-up can affect their ability to help you later on.

If you use an SMSF professional to help you set up your fund, you're still responsible for making sure it's done correctly:

An accountant can help set up your fund's financial systems and, once you are operating, they can prepare your fund’s accounts and operating statements.

A fund administrator can assist with administrative tasks during start-up and, afterwards, help you manage the day-to-day running of your fund and meet your reporting and administrative obligations.

A legal practitioner can prepare and update your fund’s trust deed.

A financial adviser can help you prepare an investment strategy and advise you about different types of investment and insurance products.

You'll need an approved SMSF auditor to audit your fund.

A tax agent can complete and lodge your SMSF annual return, provide tax advice and represent you in your dealings with the ATO.

2: Choose individual trustees or a corporate trustee

You can choose one of the following structures for your fund:

up to four individual trustees

a corporate trustee (essentially, a company acting as trustee for the fund).

You should discuss this decision with an SMSF professional. The two structures differ in terms of:

1. Member and trustee requirements

2. Cost

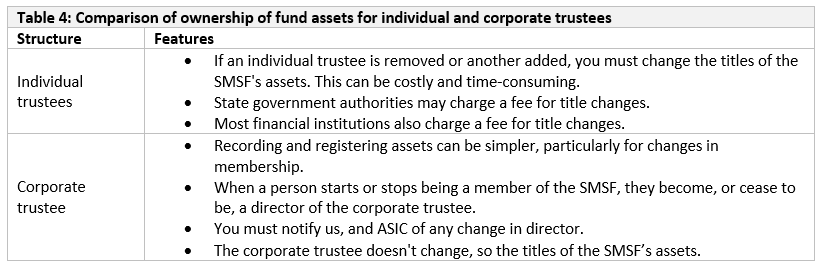

3. Ownership of fund assets

The title of fund assets must be in the name of the current trustees 'as trustees for' the fund.

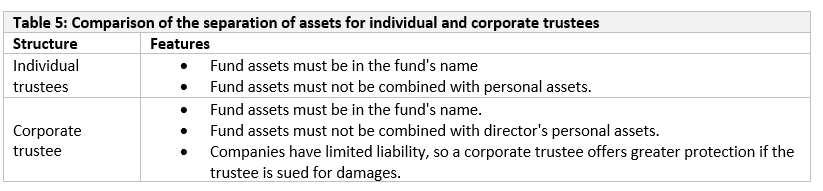

4. Separation of assets

The fund's assets must be kept separate from any assets members hold personally.

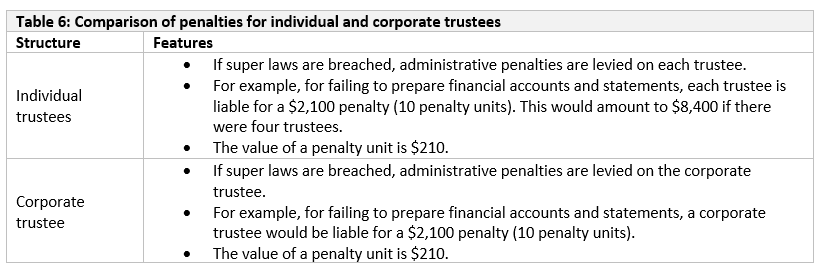

5. Penalties

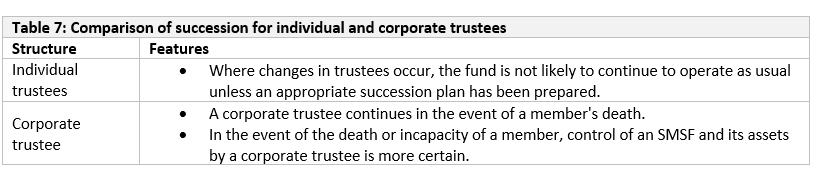

6. Succession

3: Appoint your trustees or directors

All members of the fund must be individual trustees or directors of the corporate trustee. New funds usually appoint trustees or directors under the fund’s trust deed.

You need to ensure that the people who become trustees or directors of the SMSF:

are eligible to be a trustee or director

understand what it means to be a trustee or director.

All trustees and directors must:

consent in writing to their appointment

sign the Trustee declaration stating that they understand their duties and responsibilities (this must be done within 21 days of becoming a trustee or director).

You must keep these documents on file for the life of the SMSF and for 10 years after the SMSF winds up.

Penalties may be imposed if these things aren't done. All trustees and directors are bound by the trust deed and are equally responsible if its rules aren’t followed.

4: Create the trust and trust deed

A trust is an arrangement where a person or company (the trustee) holds assets (trust property) in trust for the benefit of others (the beneficiaries). A super fund is a special type of trust, set up and maintained for the sole purpose of providing retirement benefits to its members (the beneficiaries).

To create a trust, you need:

trustees or directors of a corporate trustee

governing rules (a trust deed)

assets (an initial nominal consideration to give legal effect to the trust can be used, for example, $10 attached to the trust deed)

identifiable beneficiaries (members).

a) Trust deed

A trust deed is a legal document that sets out the rules for establishing and operating your fund. It includes such things as the fund’s objectives, who can be a member and whether benefits can be paid as a lump sum or income stream. The trust deed and super laws together form the fund’s governing rules.

The trust deed must be:

prepared by someone competent to do so as it's a legal document

signed and dated by all trustees

properly executed according to state or territory laws

regularly reviewed, and updated as necessary.

b) Assets

To establish your fund, assets must be set aside for the benefit of members.

If a rollover, transfer or contribution is expected in the near future, a nominal amount (for example, $10) can be held with the trust deed. This amount is regarded as a contribution and must be allocated to a member.

If a member can't contribute to the SMSF (for example, they are over 65 or don't meet the work test), an administrative discretion is automatically applied to allow a nominal contribution for the member. The amount must be allocated to the member, solely for the purpose of registering the SMSF.

5: Check your fund is an Australian Super Fund

To be a complying super fund and receive tax concessions, your SMSF needs to be an Australian super fund at all times during the financial year.

If your fund stops being an Australian super fund because it does not satisfy the residency rules, it may become non-complying, and its assets (less certain contributions) and its income are taxed at the highest marginal tax rate.

6: Register your fun and get an ABN

Once your fund is established and all trustees have been appointed (including signing the Trustee declaration), you have 60 days to register the SMSF with the ATO by applying for an Australian business number (ABN).

When completing the ABN application you should:

ask for a tax file number (TFN) for your fund

elect for your fund to be an ATO-regulated SMSF. If you don't, your fund will not receive tax concessions and the members’ employers can't claim deductions for contributions

register for GST (if necessary).

7: Set up a bank account

You need to open a bank account in your fund’s name to manage the fund’s operations and accept contributions, rollovers of super and income from investments. This account is used to pay the fund’s expenses and liabilities.

If you did not provide your financial institution details when you registered your fund, you must provide this information to us now.

The fund’s bank account must be kept separate from the trustees’ individual bank accounts and any related employers’ bank accounts.

You don't have to open a separate bank account for each member but you must keep a separate record of their entitlement, which is called a 'member account'. Each member account shows:

contributions made by or on behalf of the member

fund investment earnings allocated to them

payments of any super benefits (lump sums or income streams).

8: Get an electronic service address

If your SMSF will receive contributions from employers (other than related-party employers), it needs to be able to receive the contributions and associated SuperStream data electronically.

SuperStream is a data and payment standard that applies to super contributions made by employers to any super fund, including SMSFs.

To receive SuperStream data you need an electronic service address, which is a special internet address. It's different to an email address.

Your administrator may provide you with an electronic service address or you can use a ‘SuperStream message solution provider’.

An employer will need the following information about your SMSF:

ABN

bank account details (BSB and account number)

electronic service address.

9: Prepare an exit strategy

Even when you're setting up your SMSF you need to consider what happens when your SMSF ends, or 'winds up'.

Sometimes SMSFs become difficult to manage because of an unexpected event such as:

a relationship breakdown between the trustees

an illness or accident that leaves a trustee incapacitated (and unable to perform their role as a trustee)

a trustee dies.

Having an exit strategy may reduce the impact of 'unexpected' events. As part of your exit strategy, some of the things you should consider are:

ensure all trustees can access the SMSF's records and electronic transaction accounts

include specific rules in your fund’s trust deed that are triggered by events that could otherwise lead to the fund becoming unmanageable

members to make binding death benefit nominations (and renew them every three years)

encourage members to appoint an enduring power of attorney

the likely costs involved in winding up an SMSF.

Source: Australian Taxation Office https://www.ato.gov.au/Super/Self-managed-super-funds/Setting-up/

Date: 1 April 2018